The WHO, WHAT, WHEN, WHERE, WHY, and HOW of REFINANCING

The WHO, WHAT, WHEN, WHERE, WHY, and HOW of REFINANCING

WHO – We’ll get back to this one, later on.

WHAT – Refinancing means changing the amount, term, or rate of your current loan electively, in order to better suit your needs. The most common reasons you might refinance are in order to pull cash out of the equity of your home, to lower the interest rate and payments, or to adjust the term of your loan (for example if you had an adjustable rate and wanted to change it to a fixed rate instead)

WHEN – in general you can refinance at any time, but your loan officer can help guide you with this. Please note that the VA has a strict requirement of 210 days having elapsed from the closing of your previous mortgage before you are eligible to refinance.

WHERE – all mortgage lending companies can close refinances, and in most cases the process is much more simple than a purchase. There is less documentation, and since you already live in or own the home so there is no other party to deal with which makes things much easier to manage. Additionally, almost all lenders in the US can complete the entire loan electronically so with the exception of a few closing documents you never even have to set foot in an office (but you SHOULD if you have any questions or want to learn more, it’s FREE)

WHY – we’ve covered a few of these above, but in more detail here are some and examples:

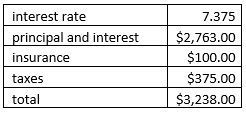

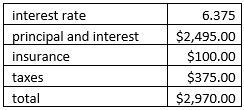

Rate/Term refinance: A rate/term refinance is most often used to lower your interest rate, and thus lower your monthly payments. For example, if you purchased a $500k home and put 20% down, you would owe $400k. Your payment may look something like this

Now if you were to be able to drop your interest rate by 1.0% you could adjust your mortgage payment to this

As you can see, this is a savings of $268/month. It is up to you and your loan officer to determine if that savings is enough to offset the closing costs associated with the loan, and your monthly budget. The VA requires that all rate/term refinances save you enough money that they offset the closing costs within the first 36 months (sometimes referred to as the break-even-point), and this is a very good rule to follow. In this case, your closing costs could be as high as $9648 for it to meet that requirement (and please note that closing costs and prepaids are not the same thing, and prepaids should be excluded from the calculation). We generally prefer to use an even more aggressive 24 months as the recoup period, but it is always up to both the borrowers and lenders to create their own threshold they are comfortable with.

Cash-out refinance: A cash-out refinance is where you convert a portion of the equity in your home into cash, in order to use it for future investment. Whether that means paying off consumer debts, or home improvements, or purchasing a vehicle, there are few restrictions on what you can do with the funds. In general, the rule of thumb is that for a cash-out refinance you can go up to ~80% of the value for a conventional loan, or 90% of the value for VA. For example, if you purchased a home for $400k, and put 25% down you would owe $300k. (disregarding the principal you may have paid down during the time you owned the home for simplicity) If that homes value has increased since the time you purchased it (you can use online tools, but we advise speaking to your loan officer to help) to $500k, then you would be eligible to refinance the $300k you owe, on your home worth $500k now, and change your loan amount to $400k putting the $100k difference in your pocket.

There will even be some cases where you can take cash out, AND lower your interest rate and payment. These won’t be typical, but they do happen. If your loan officer isn’t monitoring things like this for you then you should be working with someone who is!

Eliminating PMI – If your home has appreciated in value since you purchased it and you now have sufficient equity, refinancing could allow you to eliminate the requirement for private mortgage insurance (PMI), potentially reducing your monthly payments. In most cases you will also be able to lower your interest rate as well, but not all. It is important to consider this factor, because in some cases (most times with a significant increase in credit score) it alone can be enough to make the difference to move forward.

HOW – applying with your lender is the best place to start, but we would also encourage you to just reach out to someone you know like and trust. Oftentimes refinancing is very dependent on timing so it helps to have a plan in place ahead of time so you can prepare to pull the trigger. The real estate and interest rate market can be extremely volatile, and working with professionals who can help navigate tumultuous times can be the difference in thousands of dollars in your pocket. Remember that you should NEVER have to pay a fee to apply for a home loan!

Back to WHO – well if you’ve made it this far, then let us suggest Fairway PNW! We do a couple things that very few lenders do, including monitor rates for you forever. That means that as time goes on we are constantly watching your rate vs. what would be available, and also the approximate value of your house in regards to what you paid and your equity position. If it makes sense for us to take a closer look we will reach out, and if we think we might be getting close we reach out to let you know. It takes a team to monitor everything, but we also pride ourselves on making sure we are available if you have any questions. If you have done renovations, or paid down a chunk of the balance, or any of a bunch of things there would be no way for us to know. Call/text us anytime and we’ll take a look and see where you stand quickly.

*Tips and tricks*

1. Remember that refinancing means “skipping” at least one payment, and maybe two depending on what you need. This can be a handy way to keep a bit more cash in your pocket at closing. (please note that you are not really skipping the payment, as the interest is still collected, but it is done so at closing so it is usually wrapped into your loan and not an out of pocket expense)

2. Almost all refinances can be paid with the proceeds of the loan, so you don’t need to come to the table with any cash out of pocket! If you are paying something at closing, please call us to look at it for you even if we are not the ones doing the loan for you!

3. All refinances on primary residences require a 3 day waiting period after you sign to close called the right of rescission. I.E. if you sign your closing docs on a Monday, we can’t close your loan until Friday. (Saturdays count, Sundays and holidays do not). This will mostly affect your rate lock, so be sure to work with someone you trust to monitor this as extensions to your rate lock are an avoidable borrower cost.

4. You can pull cash out of your home now for the purchase of your next home! If you plan to retain your current primary and convert it to a rental, your loan officer can help you with structuring it in a way that meets all the necessary guidelines and still allows you to access the available funds! This is MUCH EASIER than trying to do so after you’ve purchased your next home.

5. You can pull cash out to buy a family member a home. In each instance the specific relationship will affect the plan, so we highly recommend someone very well versed in what to do and how to do it.

Confidentiality Notice:

Confidentiality Notice: The information contained in and transmitted with this communication is strictly confidential, is intended only for the use of the intended recipient, and is the property of Fairway Independent Mortgage Corporation NMLS #2289 or its affiliates and subsidiaries. If you are not the intended recipient, you are hereby notified that any use of the information contained in or transmitted with the communication or dissemination, distribution, or copying of this communication is strictly prohibited by law. If you have received this communication in error, please immediately return this communication to the sender and delete the original message and any copy of it in your possession. WA License Number MLO-1377661.

Business Hours:

Available 24/7 Including Weekends

Phone: (360) 900 9590

Email: teamlakecameron@fairwaymc.com

Address: 9633 Levin Rd NW Suite 101, Silverdale, WA, 98383