Sifting Through Ashes For Seeds Of Hope

Sifting Through Ashes For Seeds Of Hope

There's no way to sugarcoat the situation in the bond market and, by extension, the mortgage and housing markets. Rates have risen at a nearly unprecedented pace, ushering in one of the quickest cooldowns on record. One of the only ways to find hope in this environment is to imagine that bad news is finite.

To be clear, "bad news" is relative, because it has been the resilience of the domestic economy that has allowed rates to rise as aggressively as they have so far. This isn't necessarily a direct relationship, but the Fed is looking for a few pieces of evidence that its unfriendly policies are having the desired effect, and one of those pieces would be rising unemployment.

So far, unemployment has remained low, inflation has remained high, and the Fed has remained very unfriendly toward rates. They've been so unfriendly that market participants have increasingly wondered how much they can get away with before signs of uncommon stress how up in rate markets and elsewhere.

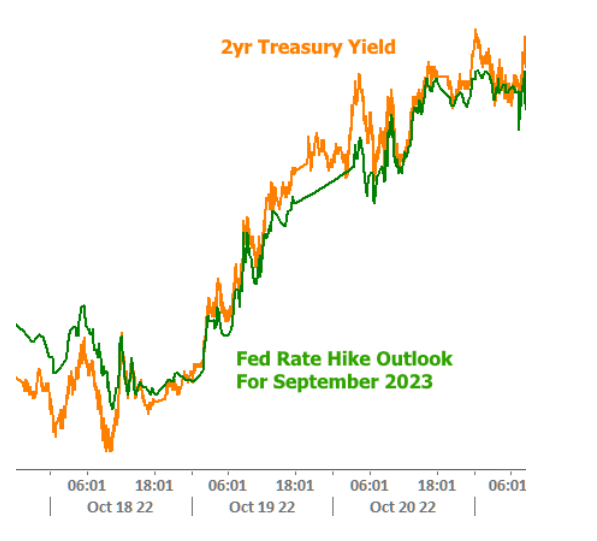

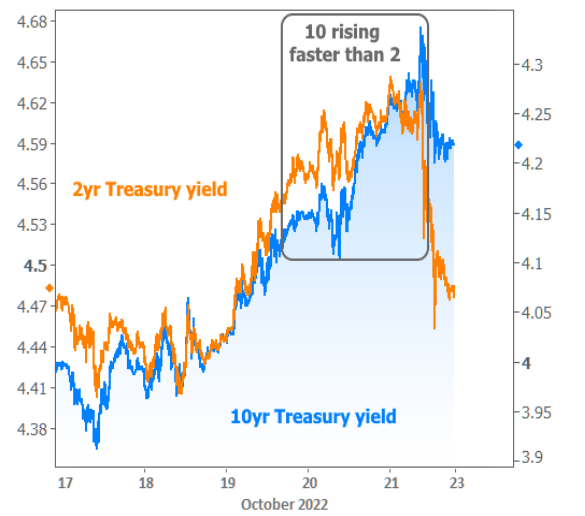

We may have witnessed some of that stress this week--especially in the second half which saw longer-term rates surge higher without any obvious provocation. At this point, we should distinguish between longer term rates (like 10yr Treasury yields or mortgages) and shorter term rates(like a 2yr Treasury or the Fed Funds Rate). Differences in the behavior between long and short term rates can offer clues about market psychology.

In the 2nd half of the week short term yields moved higher, faster at first. When shorter-term yields are rising faster in 2022, it often goes hand in hand with the perception that the Fed will be hiking its Fed Funds Rate faster. To illustrate this point, here's a quick look at the relative movement in 2yr Treasury yields and Fed Funds Rate predictions for September 2023.

After short term rates spiked, longer-term rates paradoxically began to spike more. This was most noticeable on Thursday and again on Friday morning.

This is uncommon behavior in 2022! It suggests some resistance on the part of market participants that the Fed will be able to get away with a much higher rate hike trajectory. At the same time, longer term rates moved higher in protest of the Fed's persistent unwillingness to admit that its unfriendly policies have already begun to work their way through the system even if they're not seeing it in their preferred economic reports.

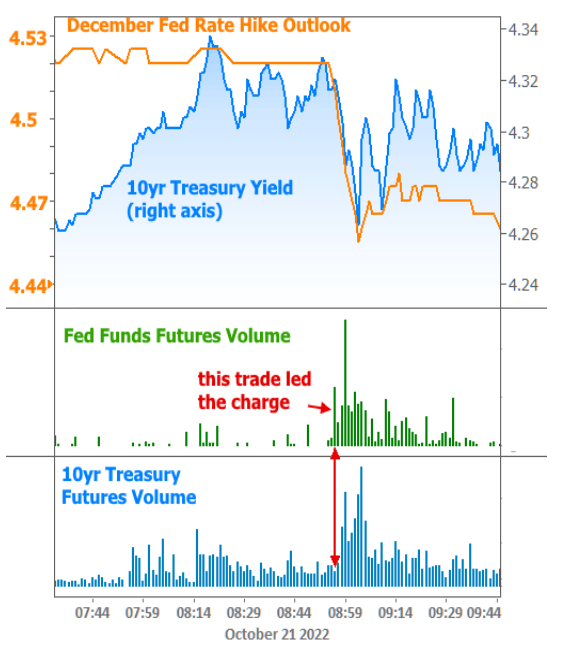

By the 8am hour on Friday, the bond market was arguably breaking down into a somewhat panicked state. Yields(a fancy word for "rates") hit the highest levels in over a decade and volatility remained high until a WSJ article came out suggesting the Fed would be debating the size of future rate hikes at the coming meeting. Moments later, big trades hit Fed Funds Futures(the securities that allow traders to bet on the Fed Funds Rate in the months ahead). Less than 1minute later and traders were pushing longer-term rates back down.

The following chart is a bit busy, but it shows all of the above. The orange line is the expected Fed Funds Rate after the Fed's December meeting based on Fed Funds Futures. The blue line is the 10yr Treasury yield, the most widely accepted benchmark for longer-term rates in the US. Trading volume for each line appears in the lower section with Fed Funds Futures volume spiking shortly before Treasuries

All that to say the market was ready for any indication that the Fed is getting close to leveling off the pace of its rate hikes. A short while later, such notions were forcefully validated by actual comments from the Fed's Mary Daly, who said several things that markets had been waiting to hear. The following bullet points paraphrase those comments:

- We want to avoid an unforced downturn by overtightening

- If we wait to see lagging variables like unemployment and inflation return to a steady state, we could easily overtighten

- We are starting to see the economy slowing

- We are now in a stage where we need to be thoughtful

- A slower pace of rate hikes should be considered at this point

All of the above is very important because it suggests the sentiment exists among Fed members to begin to consider a rate friendly shift in monetary policy. To be sure, this by no means suggests and easy victory or quick return to lower rates. It also wouldn't lessen the importance of economic data in confirming that inflation isn't getting any higher. But it's one small step in the right direction--one small seed of hope in the ashes of the housing and mortgage market in the 2nd half of 2022.

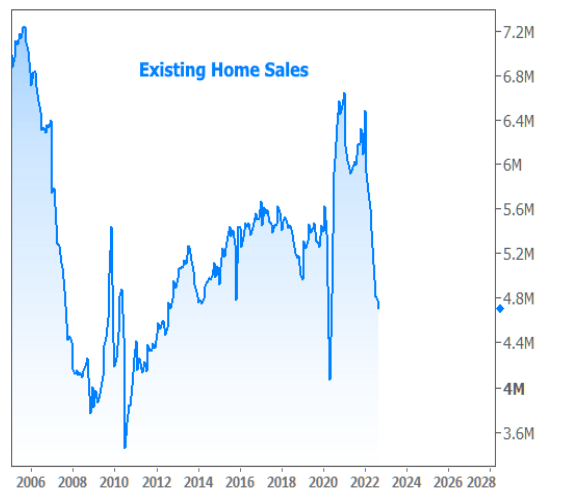

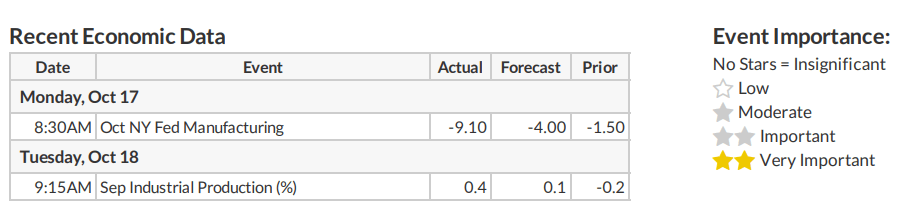

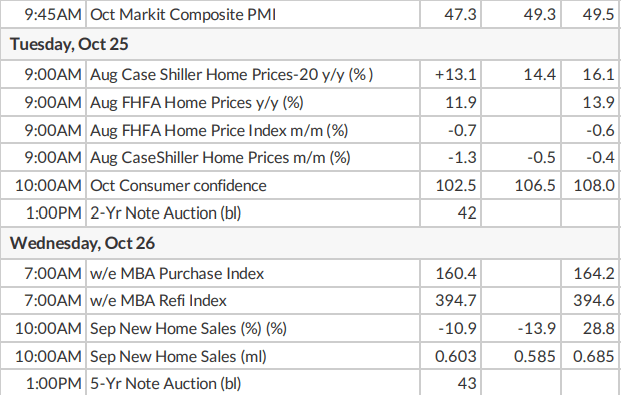

Is this imagery overly dramatic? It depends on one's perspective. Few would disagree that home price gains were sustainable or that the industry didn't need to cool off a bit. But it would be similarly hard to disagree that pace of change in rates and sales has been more abrupt than would be ideal. Unfortunately, when an industry is heavily dependent on the one thing the Federal Reserve uses to fight inflation, things are going to get bumpy when inflation is at its highest levels in decades. Here's the latest damage from some of this week's economic data:

Existing Sales, as reported by the National Association of Realtors didn't fall too much from the previous month, and they were fairly close to forecast levels, but those forecast levels were 2million homes below the recent peak in terms of annual pace

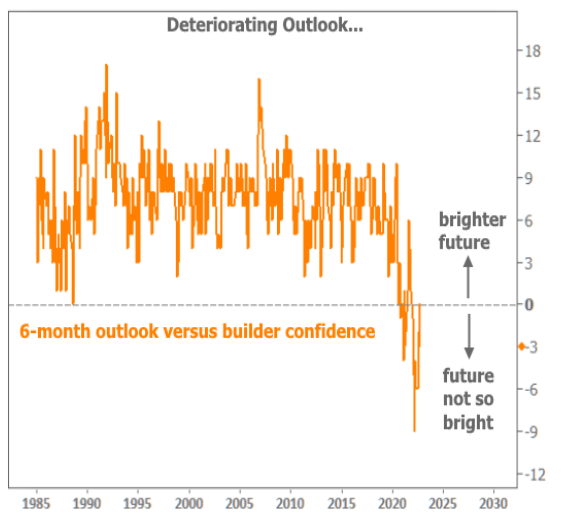

The National Association of Homebuilders released a very gloomy Housing Market Index (essentially "builder confidence"). The index dropped sharply from 46 last month to 38 this month, massively undershooting the median forecast of 43.

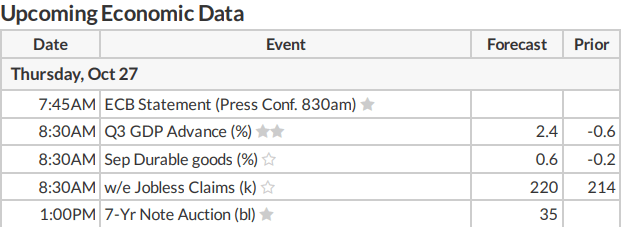

The 6month outlook fell even more, which is notable because it almost always runs higher than the overall builder confidence index. The following chart compares the 6month outlook to the headline number. This simply speaks to the pervasive fear among builders that things will get even worse from here

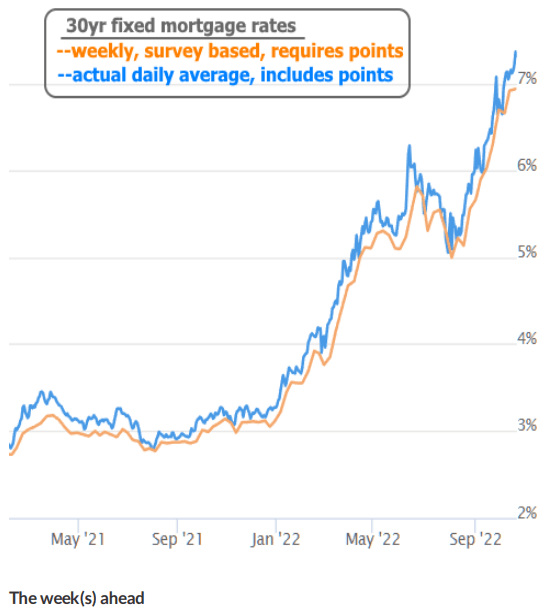

Notably, the data was not collected until the mid 80s, and it's possible if not likely that a similar pattern would have emerged in the early 80s, the last time interest rates rose at such a pace. Speaking of rates, multiple news outlets missed the mark again this week due to their reliance on stale weekly survey data. Actual, up-to-date numbers suggest an average 30yr fixed rate well into the 7% range.

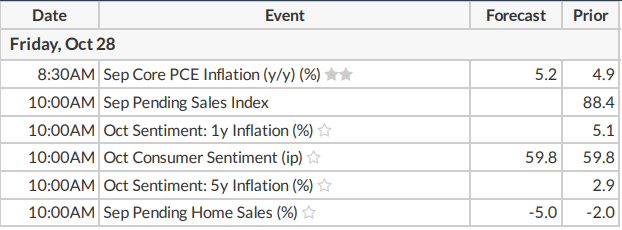

The coming week has several somewhat relevant economic reports, but it's more of a placeholder. The following week will be exceptionally important a sit brings the much-anticipated Fed announcement as well as the next installment of the jobs report. The week after that is also critically important due to the November 10th release of the next Consumer Price Index (CPI), the inflation report that has done more than any other report to shape rate movement in recent months.

Subscribe to my newsletter online at: http://housingnewsletters.com/kmillerteam

Confidentiality Notice:

Confidentiality Notice: The information contained in and transmitted with this communication is strictly confidential, is intended only for the use of the intended recipient, and is the property of Fairway Independent Mortgage Corporation NMLS #2289 or its affiliates and subsidiaries. If you are not the intended recipient, you are hereby notified that any use of the information contained in or transmitted with the communication or dissemination, distribution, or copying of this communication is strictly prohibited by law. If you have received this communication in error, please immediately return this communication to the sender and delete the original message and any copy of it in your possession. WA License Number MLO-1377661.

Business Hours:

Available 24/7 Including Weekends

Phone: (360) 900 9590

Email: teamlakecameron@fairwaymc.com

Address: 9633 Levin Rd NW Suite 101, Silverdale, WA, 98383